Spicejet takes off for financial boost

Spicejet takes off for financial boost

Spicejet has sold off its shares and raised a handsome amount of Rs 3,000 Crore from its qualified institutional buyers, providing a financial boost for the airline. The funding would involve major foreign entities, helping the company to address its financial liabilities.

Domestic flyer SpiceJet on Monday said it has raised Rs 3,000 crore through a Qualified Institutional Placement (QIP).

The foreign entities that are involved in this fundraising effort are Goldman Sachs (Singapore), Discovery Global Opportunity (Mauritius) Ltd, Authum Infrastructure and Investment, and Troo Capital, Nomura Singapore and Societe Generale.

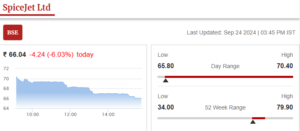

Spicejet shares price

It is aimed at raising Rs 3,000 crore at an issue price of Rs 61.60 per share, giving a rise to the equity share capital drastically. The premium of this issue price is set for Rs 51.60 per unit and a discount of Rs 3.19 from the floor price.

On 20th September, the fundraising committee of Spicejet had approved the allotment of over 48.70 crore shares at a price of Rs 61.60 per share to over 80 QIP participants as per a regulatory filing. It has brought an increase in the company’s paid-up equity share capital from Rs 7,94,67,27,170 to Rs 12,81,68,57,030.

Domestic market share

As per the Directorate General of Civil Aviation (DGCA), the domestic market share of the company fell down to 2.3 percent in August from 5.6 percent at the beginning of the year. This decline highlights ongoing financial challenges, worsened by disputes with the leasing companies and technical issues that have kept many of its flights grounded.

Additional funding

The airline company is also set to welcome Rs 750 crore additionally from the previous funding, further rising its financial stability and growth plans. The chairman and managing director, Ajay Singh commented that the fundraise marks a critical moment for the company as they plan to scale new heights in the aviation industry. As per Ajay, with the help of this new capital, the airline company is determined to paint the skies red once again- the color of Spicejet.

Finance Ministry to the DRT Management

Future Goals with the funds

As per the airline, this newly made capital will be used in executing grounded aircraft, acquiring new planes, investing in innovative technology, and expanding into new markets.

The funding from this equity issue is intended for enormous crucial objectives which aims at stabilizing the airline’s financial health and helping it to resume full operations. The primary goal includes settling dues totaling Rs 601.5 crore, which

The proceeds from this equity issue are intended for several critical objectives aimed at stabilizing SpiceJet’s financial health and resuming full operations. A primary goal includes settling statutory dues totaling Rs 601.5 crore, which consists of obligations for Tax Deducted at Source (TDS), provident fund contributions, and Goods and Services Tax that have been delayed due to financial limitations and restrictions.

Conclusion

With the help of this financial boost, Spicejet aims to achieve great benefits in its financial health and overcome liabilities or obligations of lenders and banks. As per the company, the funding will be used for improving the airline services and providing more and more of flights to help people and Spicejet both fly higher.