Navi operating profit spikes up!

Navi operating profit spikes up!

The firm led by co-founder of Flipkart, Sachin Bansal is Navi Finserv had faced many challenges to scale up its revenue and profitability in the financial year ending March 2024.

Even after a 6.6% decline in scale, its operting profit has decreased by more than 50% which was driven by a fall in collections and rise in loan write-offs basically bad debt.

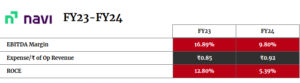

Financial health of the company- Navi

According to the consolidated annual report of the firm, the revenue particularly from operations declined to Rs 1,906 crore in the financial year 2024, which previously had been Rs 2,041 crore in the financial year 2023.

The company offers services for instance bill payments, digital gold, insurance, home loans, and mutual funds.

The interest income made up 84.5% of its total revenue but had seen a decline of 12.3% reaching to Rs 1,611 crore in the last financial year 2024.

The commissions, fees, gains on fair value and other financial instruments have brought the firm’s total income to Rs 1,909 crore in the financial year 2024 which is down from Rs 2,078 crore in financial year 2023- which has reflected an 8.1% year by year decline.

Revenue and Expenditure breakdown of the company- Navi

As far the other leading companies are accounted, the finance costs were the biggest expenditure for Navi,

As with other lending companies, finance costs were the largest expenditure for Navi, counting for 37.6% of total expenses. These costs also led to a decrease by 4.8%, reaching Rs 658 crore in financial year 2024. In addition to this, Navi reduced employee benefits by 41.9%in 2024.

Remarkably, the company’s loan bad debts have seen a drastic surge – 3.2 times to Rs 406 crore in the financial year 2024, which was up from Rs 125 crore in the financial year 2023. The costs such as fees, software, legal expenses, commissions, customer onboarding pushed the total expenditure to Rs 1,750 crore in the financial year 2024.

About Svatantra Microfin

The major write-offs led to a 56% decrease in operating profits of the firm- making a high drop to Rs 159 crore from Rs 335 crore in the financial year 2023.

Still, despite this fact, the firm posted a net profit of Rs 545 crore in the financial year 2024, mainly due to the gain it received of Rs 429 crore from the sale of Svatantra Microfin, which is a former subsidiary of Navi.

Svatantra Microfin, was sold to Chaitanya India Fin Credit for an entire consideration of Rs 1,166 crore in November 2023.

History of financial year 2020-21

Coming as a shock, it has previously happened with the firm, when it had posted a profit of INR 71 Cr in FY21, a significant improvement after incurring a loss of INR 8 Cr in FY20. Navi saw its total income rise by 25% from INR 221 Cr in FY20 to INR 780 Cr in FY21. Let’s see how the results come off for FY24-25.

Read more about the FY20- FY 21 at Navi Clocks INR 71 Cr Profit After Incurring Loss of INR 8 Cr (inc42.com)

Conclusion

The firm led by co-founder of Flipkart, Sachin Bansal is Navi Finserv had faced many challenges to scale up its revenue and profitability in the financial year ending March 2024.

According to the consolidated annual report of the firm, the revenue particularly from operations declined to Rs 1,906 crore in the financial year 2024, which previously had been Rs 2,041 crore in the financial year 2023.

The commissions, fees, gains on fair value and other financial instruments have brought the firm’s total income to Rs 1,909 crore in the financial year 2024 which is down from Rs 2,078 crore in financial year 2023- which has reflected an 8.1% year by year decline.

Svatantra Microfin, was sold to Chaitanya India Fin Credit for an entire consideration of Rs 1,166 crore in November 2023.

Read out more such articles only at- Funding Surge: UPI Achieves Outstanding Record Breaking 15 Billion Transactions In September – 24 Khabre